Green hydrogen: Too costly to have a future?

Many are optimistic that hydrogen will play a critical role in decarbonizing parts of the economy that are challenging to electrify. These “hard-to-abate” sectors such as heavy-duty transportation, industrial heat for steel and cement making, and backup power sources together account for around 30% of global emissions.

In the last four years, hydrogen investments have soared, with $75 billion now committed to projects around the world and a further $600 billion announced. Most of these have been in Europe and North America, where governments are providing strong financial incentives for hydrogen production.

Hydrogen is a clean fuel when burned – the only byproduct is water. The trouble is that hydrogen must be extracted from other compounds. Conventionally, this has meant separating hydrogen from natural gas or coal (known as “gray hydrogen”), a process that emits carbon. It is also possible to use clean electricity from wind, solar, or hydropower to separate water into hydrogen (H2) and oxygen (O2) without emissions. This form of electrolytic hydrogen – “green hydrogen” – has been the focus of investor interest, given the precipitous decline in the cost of wind and solar technology in recent decades.

Though production costs remain high – today it costs three times more to make green hydrogen than the gray kind – advocates argue that with enough deployment, production costs will fall, even possibly becoming competitive with fossil fuels. The driving force? The same economies of scale, innovation and learning-by-doing which so dramatically brought down the cost of wind and solar in the last few decades.

Yet few analyses consider the costs beyond production – production is just one step in the hydrogen supply chain. Storage and distribution costs are central to the “hydrogen ecosystem” that Airbus cited this month when it announced delays in its efforts to produce a hydrogen-powered passenger plane.

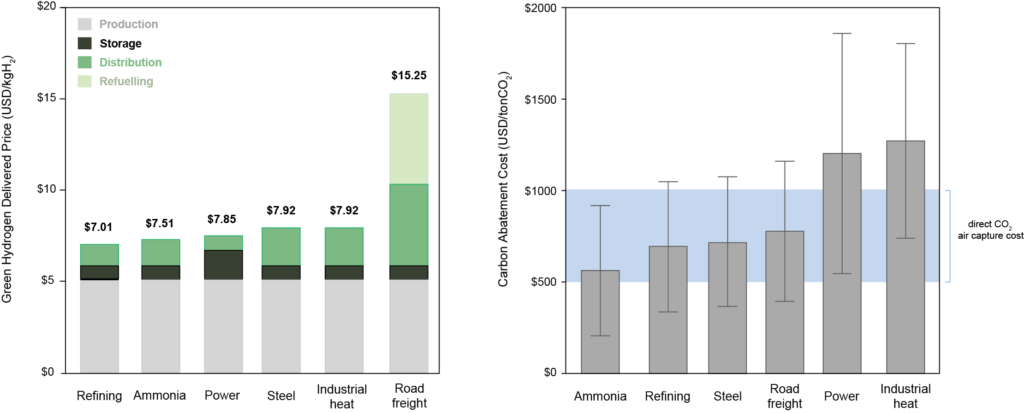

Our recent paper in Joule shows that, when considering storage and distribution costs, the final delivered price of green hydrogen to end users, from heavy industry to trucking, is higher than what current estimates predict and unlikely to decline to affordable levels in the future. We calculated, under a range of scenarios now and in the future, that it will often be cheaper to pull carbon dioxide from the atmosphere (something you might do to fight climate change) than to use green hydrogen in many sectors.

To see how storage and distribution contribute to end costs, look at southern California. At the handful of stations that dispense hydrogen for the estimated 13,000 fuel-cell cars registered in the state, hydrogen costs the equivalent of $16 per gallon of gasoline – ten times more than it costs to produce. Most of that $16 is not production, but storage and distribution.

Isn’t it possible that all these stages – production, storage and distribution – will decline in cost over time?

First, consider production. Investors argue that electrolyzers – the critical technology used to separate hydrogen from water with electricity – will follow typical technological learning curves, with costs falling as deployment increases. This reduction in capital cost would allow green hydrogen producers to use intermittent, low-cost electricity generated from renewables instead of costlier – and dirtier – electricity from the grid. However, producing hydrogen only intermittently – when the sun is shining, or the wind is blowing – also lowers the rate at which remaining capital equipment needed to deliver hydrogen, including storage and distribution infrastructure, is utilized. That increases prices significantly. Producers may therefore be forced to connect to a more constant electricity supply – increasing electricity and, therefore, production costs – and sacrificing the zero-carbon certification. At higher utilization rates, electrolyzers today constitute less than 15 percent of the production cost; most is the price of electricity. So a future drop in the price of electrolyzers will not change the overall equation much.

What about storage and distribution? Hydrogen’s low molecular weight means it is more challenging and costly to store and transport relative to conventional fuels like gasoline or diesel. It must be compressed or liquified by cooling it to -423 degrees Fahrenheit – an energy-intensive endeavor. Hydrogen can make metal pipes brittle, so it’s not possible to use old oil and gas infrastructure; hydrogen needs its own dedicated pipelines and storage facilities.

Keeping options open

This does not mean costs will never decline. Some may fall with innovation, including new technologies for storing and shipping hydrogen at higher densities or converting H2 into other chemical forms. One option is to convert hydrogen into ammonia, which is much easier to ship and store – though too much energy is lost in the conversion process currently to make this a viable alternative today.

Hydrogen’s high delivered price signals that we need to keep our options open. This means investing in a wider range of technologies at all levels of maturity, not picking the winning technology before it is ready. It is also important to support alternative approaches to the decarbonization of these sectors, including advanced biofuels, advanced battery, and charging technologies, and approaches for electrification of high-grade heat.

There is likely a role for green hydrogen to play in the energy future. It might turn out to be the best or perhaps the only way to reduce emissions from some sectors like cement or steelmaking. To replace petroleum-based jet fuel or marine fuel, hydrogen or hydrogen-derived fuels like ammonia may be a contender. But based on our analysis, barring some remarkable technological breakthrough, relying on hydrogen for these sectors means that the cost of the clean energy transition will be higher than many people expect.

All perspectives expressed in the Harvard Climate Blog are those of the authors and not of Harvard University or the Salata Institute for Climate and Sustainability. Any errors are the authors’ own. The Harvard Climate Blog is edited by an interdisciplinary team of Harvard faculty.